Kyvio Blog

Recession is Coming - Here's How to Prepare Your Business

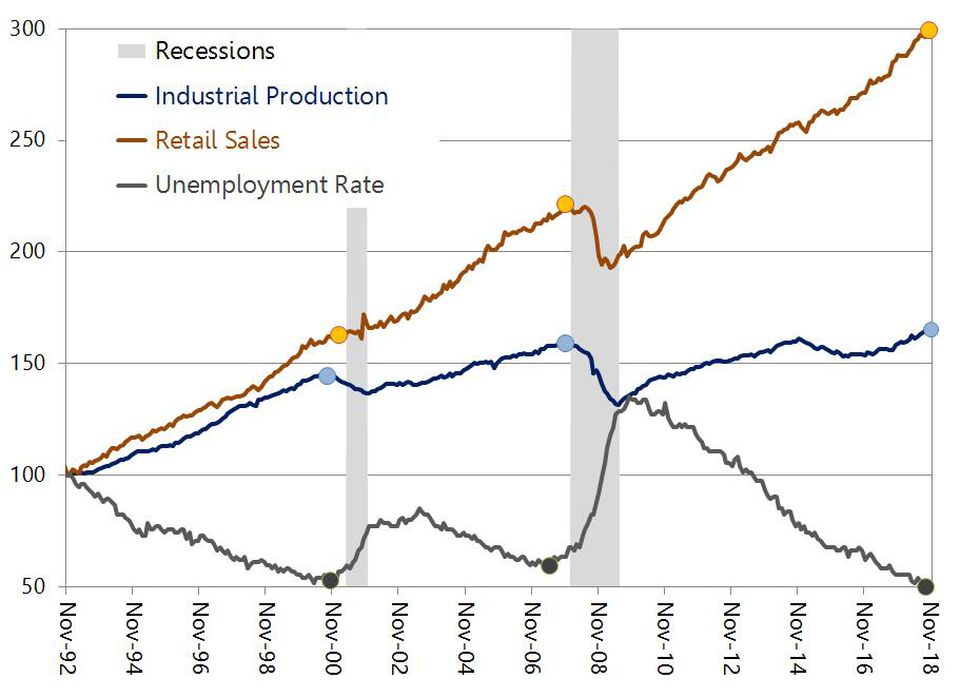

It has been over a decade since one of the worst recessions in modern history occurred. The financial crisis of 2008, aka the Great Recession, was a period of economic decline that affected millions of people worldwide.

Note that the Great Recession differs from the Great Depression of the 1930s. Although there has been some argument about which was worse. This article focuses on a recession and not a depression. A Recession may last for several months up to a year, but a Depression could last for years!

Many people were unprepared for the Great Recession. As a result, they suffered the full impact. But those who were prepared thrived.

As Baron Rothschild said, “the time to buy is when there’s blood in the streets.” Investors followed this contrarian investment style by buying when others were selling. And they made a fortune doing it.

Financial and economic analysts are now forecasting another recession between 2019 and 2021. Now is the perfect time to get your business (and finances) recession-proof.

To get started, you need first to understand what a recession is, and how we know, it is imminent. By the end of this article, you will know how to best prepare for the recession. Plus, we cover how to create a knowledge business that will thrive in ANY economy.

What is a Recession?

The definition of a recession has several variations. Economists define a recession as two consecutive quarters of negative growth in the gross domestic product (GDP).

Meanwhile, the National Bureau of Economic Research defines it differently. They say it is a “significant decline in economic activity spread across the economy, lasting more than a few months.”

Both definitions are accurate. They both imply the same thing – a general decline in the economy. They also both indicate the same economic results. Such as loss of jobs, a downturn in real income, a drop in industrial production and manufacturing, and a decline in consumer spending.

How a Recession Impacts You

One thing is crystal clear: a global recession is around the corner. Whether or not it will it be worse than in 2008, nobody knows yet.

Governments have been trying hard to avoid the recession by pushing it back. The problem is, in most cases, the further they push back, the harder the ax will fall, making the impact more serious.

In a nutshell, a recession means:

Many people will get fired

Many businesses will fold

Many people will lose a lot of money

People will get unhappy and angry (and might blame minorities)

There will be a rise in the crime rate

Wars might happen (hopefully not)

Wondering why we are so sure about the recession?

Strong Indicators that the Recession is Coming

Several indicators are pointing to an impending recession. These include expanding corporate debt. Germany’s shrinking GDP. Government yields that are prominently lower than the previous long-run average. Negative returns on the S&P 500. The reduced GDP growth in China is not comparable to what it was before 2010.

Bloomberg also reported that the US-China trade war and tariffs have made investors feel nervous. Which, in turn, has affected stock prices worldwide. The risk of a global recession is continually rising.

Legendary investor Ray Dalio has said there are three major signs for a global recession:

A (political) swing to the right (check; USA, Brazil, many European countries)

Global debt records (check; there’s higher global debt than ever before in the history of humankind)

A huge company or country defaulting on their debt (not yet but various countries and big companies are on the edge, including but not limited to Argentina, Deutsche Bank, various Italian Banks)

Then just recently all big European banks increased their liquidity from 2 to 3%. This clearly indicates they are expecting down-turn, all the uncertainty around no-deal Brexit (which is extremely likely now) and of course the US-China trade war.

So, the question now isn’t whether or not it is coming; it is how best to prepare.

How to Prepare for the Recession

It doesn’t matter whether you’re an entrepreneur, a business owner, or an employee. You NEED to prepare for the coming recession.

Taking the initiative to prepare now will ensure your business and finances are recession-proof. It will also help you mitigate any economic hardship and help you thrive financially.

With that said, let’s dive into our top tips to help you prepare for the coming recession.

1. Protect Your Cash Flow

Entrepreneur or employee, the importance of having a regular cash flow cannot be overstated.

As a business owner, it is the lifeblood of your business. Without regular cash flow, your business will struggle to grow – even without a recession. Putting systems in place to protect your cash flow will help you mitigate the impact of a recession.

As an employee whose cash flow depends on the business you for, things are a bit more tricky. Usually, employees are the first to feel the brunt of a recession due to the “downsizing” of staff.

As a result, employees need to put in that extra effort to protect their cash flow. How? By saving. And by creating an online business to supplement (or replace) your current income. Business owners and entrepreneurs could take a cue from this point as well.

2. Develop a Growth Mindset

Another way to prepare for the coming recession is to develop a growth mindset. This is the belief that you are 100% in control of your ability to achieve anything you want through hard work and determination.

Several companies thrived during the Great Recession because they adopted a growth mindset. You can do the same as well. How? By training yourself (and your team) on the significance of having a growth mindset.

Research has shown that people with a growth mindset are more likely to achieve their goals. They see opportunity where others see obstacles.

Developing a growth mindset will help you be ready to innovate creative solutions to problems that you may face during the recession. This allows you to delight your customers while your competitors are struggling to stay afloat.

3. Focus on Your Core Customers

Spending money is the last thing people want to do during a recession. And if they really want to spend money, they will most likely want to buy from a brand they trust

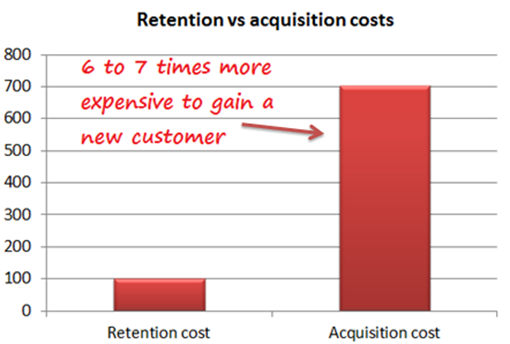

So, while it is essential to increase your customer base, we will argue that it is more important to keep your current customers satisfied. It is cheaper to retain and sell to an existing customer than it is to acquire a new customer.

(source)

The main problem with marketing to new customers is that you have to spend a lot of time, money, and effort. You also need to build trust before pitching to them. All that time is wasted because people will be looking to save money during a recession.

The effort used in marketing to new customers would yield better ROI if they spent it on current customers. By focusing on existing, loyal customers, you end up saving money while continuing to provide value.

4. Start an Online Business

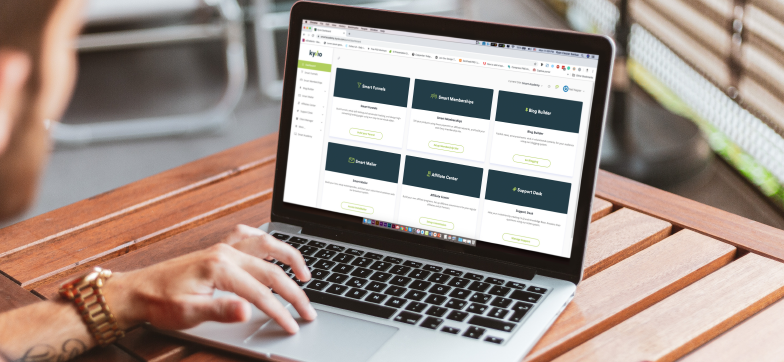

At Kyvio, starting and scaling online businesses is our bread and butter. We have done it for ourselves through multiple products. We have done it for clients we work with. We have also seen thousands of people like you do it with our easy-to-use Online Business Platform (OBP).

Sell anything with Kyvio

A lot goes into starting an online business — more than can be discussed in this section. But mainly, there are two types of online businesses we recommend people to start: online courses or membership sites.

There are several benefits to starting an online business during a recession. These include:

Low startup costs: It costs next to nothing to start an online business. Online business tools like Kyvio can save you thousands of dollars in overhead costs. Unlike a brick-and-mortar store, you won’t need to pay monthly rent, utilities, office supplies, etc.

Huge profit margins: This is dependent on the type of online business you want to start. For example, if you are selling an information product, you only need to invest in creating the product once. The product will keep making you money. This differs from an e-commerce business that requires inventory, etc.

Flexibility: Starting an online business does not restrict you to a location. You have the liberty to work from anywhere you want. Not only that, but it allows for financial flexibility. With increased profit margins, you will make more money than a traditional 9 to 5.

And if you have a traditional business, starting an online business will serve as another stream of income. Multiple income streams are essential if you want to survive the recession.

Conclusion

All evidence point to a coming recession. It is now left for you to prepare for it.

We have highlighted several ways to prepare for the coming recession. This includes protecting your cash flow and saving as much as possible. Developing a growth mindset to ensure you are ready to take advantage of any opportunity that comes up.

We also suggested that you create an online business to supplement your current income. You can create an online course or membership around your expertise. This is a business model that will thrive in any economy.

When people start losing jobs, they will look to update and expand their skills. They will turn to online courses – as these are easy and affordable. As a Kyvian and a course creator, this presents a significant opportunity for you.

At Kyvio, we believe that everyone is an Agent of Change. We use this term because we believe each person’s expertise can change the lives of thousands of other people positively.

We created Kyvio to provide Agents of Change with a modern, easy-to-use, and reliable platform. A platform to create new revenue streams to replace or supplement their current income. Income that will provide security for their future and that of their families. And all this while still positively impacting others.